Let’s keep going with the personal finance tips. Our last topic was utilizing tap-to-pay to protect your physical credit card. Now we’re going to take a look at an easy way to stay on top of your financial transactions and catch fraudulent charges as soon as possible. Of course, standard disclaimer applies: I am by no means a financial expert, and I’m writing this from a viewpoint of an average consumer and technology enthusiast.

“In a day-and-age of near instant money transfers, what’s the purpose of a checkbook ledger?”

At a young age, my parents instilled in me a strong responsibility of personal finances. I had a savings account at a young age and reconciled bank statements with my personal account ledger. That quickly migrated to money management software, first Microsoft Money and then Quicken. But then one day I realized that balancing my checkbook was an old school, unnecessary exercise. Most of the time everything was all good, and the only inaccuracies I caught were my own mistakes or missing items in my personal ledger that were accurately shown on my bank statements. In a day-and-age of near instant money transfers, what’s the purpose of a checkbook ledger? Balancing a checkbook was useful when checks floated through the mail or were being held to deposit by the recipient, but that’s simply not the norm anymore. Now it pains me when I have to (gasp!) write a physical check! (shout out to Becky who made me write my first check in a very long time…federal government, go figure.)

So what do I do to stay on top of my money if I’m not balancing my checkbook? One helpful tool has been Mint, a service that aggregates financial transactions from all my accounts into one place, which we’ll dive a little deeper into on another post. What I’ve found to be much more beneficial than balancing a checkbook has been instant mobile alerts of all transactions.

“Alerts can come right to your phone by push notification, text message, or email.”

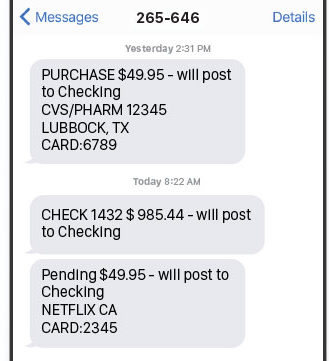

Mobile alerts can be set up with most financial institutions — bank accounts, credit cards, investment accounts, etc. Check your account settings in your apps or ask your financial institution how to set them up. Alerts can come right to your phone by push notification, text message, or email. In the sample image above, you can see that the account holder had a purchase at CVS for $49.95. Now, what if you got this alert on your phone and thought, “wait a minute, I wasn’t at CVS!”? Well then you can contact your bank immediately to dispute a charge as fraudulent. No waiting until your bank statement to arrive next month! Sure, banks and credit cards have $0 fraud protection, but it could save you a lot of headaches to catch it early.

“put that technology to work for you”

So stop wasting time balancing your checkbook just because that’s how your mother taught you. (Hi Mom! Sorry!) Start staying on top of your accounts like it’s 2020 and put that technology to work for you by enabling real-time transaction alerts on all your accounts.