For our fourth and final planned post in the financial series (NFC, Transaction Alerts, Mint), we’ll take a look at Credit Karma.

Credit Karma is an online service that lets you easily get a free credit score, credit report, and file your federal and state taxes. Just like Mint, Credit Karma was recently acquired by Intuit to build its personal finance data fortress. As with most other “free” services, you the user are the product in that your data is being mined to target personalized offers. For example, when I log in to CK, I am presented with a suggested credit card from American Express and that I may be able to save on my auto insurance. The offers are easily ignored though. The service is available in a browser and as an app for your smartphone.

“you’ll get a notification as soon as there is a hard inquiry on your credit when you (or a bad actor) applies for a new loan”

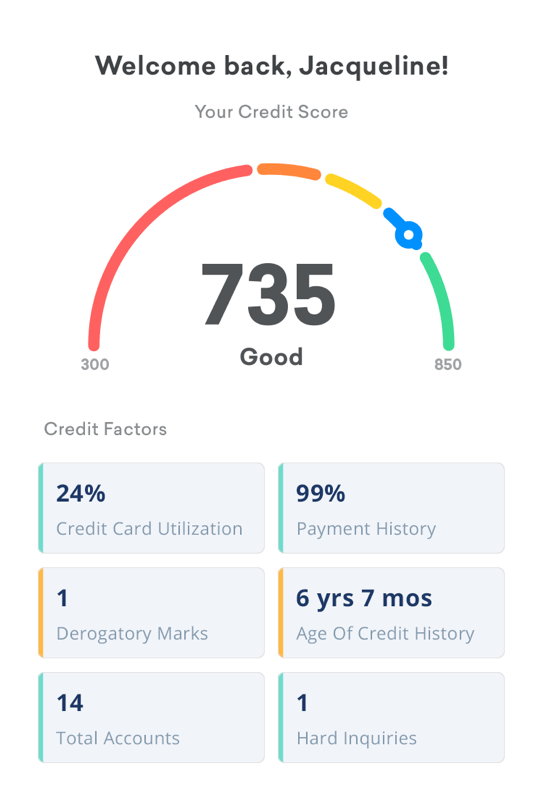

Credit Karma offers credit scores and reports from two of the three bureaus — TransUnion and Equifax. Note that you can use annualcreditreport.com to obtain credit reports from all three bureaus including Experian. Besides scores and reports, another credit-related service is monitoring for important changes to your credit report and alerting you. For example, you’ll get a notification as soon as there is a hard inquiry on your credit when you (or a bad actor) applies for a new loan. Another feature that I find useful is the credit insights that help you understand your credit report and how to improve things. For example, if you carry a high balance on a credit card, they suggest the utilization you would need to achieve to improve your credit score.

“It was easy to get started”

Lastly, Credit Karma started offering free federal and state tax filing in the last couple of years. After using H&R Block online for about 10 years, I switched to CK after H&R decided to make itemizing deductions a paid feature. CK was the only free filing site I could find that included itemizing. It was easy to get started with them since I already had an account with my personal information setup.

I find Credit Karma to be beneficial to my personal finances because maintaining a clear credit record helps ensure favorable loan rates and credit offers. CK also helps protect my credit with its monitoring and alerts.

Thus concludes my series on financial services that I use. What other services do you use? Let me know if you have any questions or other topics you would like me to cover. Thanks!